2017 has been off to a good start. I can’t believe we’re half way through February already! I’ve had a few financial setbacks such as getting a new car [which I have placed on auto pay, more on that in a minute] but a few financial gains as well! As a content creator, model and actress I’m paid on net 3o for pretty much everything I do. I just got a check from a commercial I did back in November. So the money I make for this month might not hit my bank account for 30+ days. It’s crucial that I have my finances in order to avoid feeling stressed.

No matter what your profession it’s really important to make saving your #1 priority. I’ve been on both ends of the spectrum and although it’s sometimes “taboo” to talk about money, it seems like it’s something we never have enough of. I’m very open about it, maybe a little too open but I take saving very seriously and my boyfriend is definitely sick of hearing the word savings come out of my mouth.

Tax season is upon us so I wanted to share with you some tips on how you can save some money since this is the time where most of us get a nice little lumpsum of cash. I used to tell myself that I would use my taxes to treat myself so I could go on shopping sprees or buy a really big ticketed item only to regret it literally one month later.

When I dove deeper into the realm of being an entrepreneur it became more and more important for me to stash away a little extra cash for a rainy day, or even more importantly my future. Having a bit of money in my savings account definitely made making the transition from working full time at a corporate job a lot less stressful.

My friends’ dad let me borrow his book called “The Automatic Millionaire” and let me tell you, that book changed my life. I started looking at work a lot differently. I realised the importance of working one day for myself, meaning each paycheck I would put one day’s worth of my paycheck into my savings account even before I started dividing up what was for bills and what was for leisure. That b word we hate, no not that one, the other one, budget was what helped me to change my habits. Creating a budget and tracking my income and outcome even when I didn’t want to was what had helped me immensely.

Snag your expense tracker here:

[convertkit form=4979893]This is the best way to save your first thousand dollars.

We work so hard day in and day out and I’ve been there, the feeling of not having anything to show for it can be discouraging. As soon as I made this lifestyle change I was a lot less stressed and a lot more aware of where my coins were going.

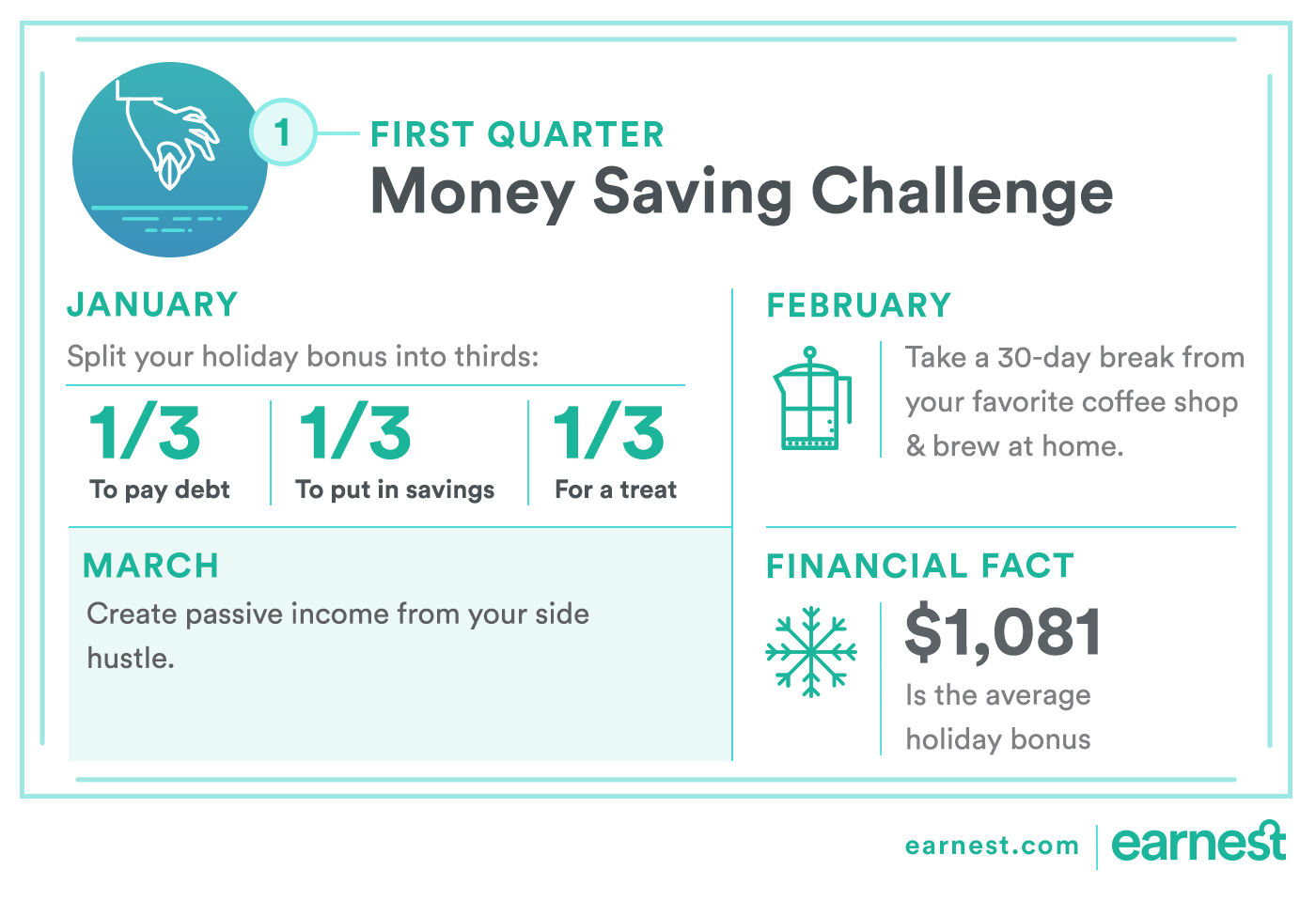

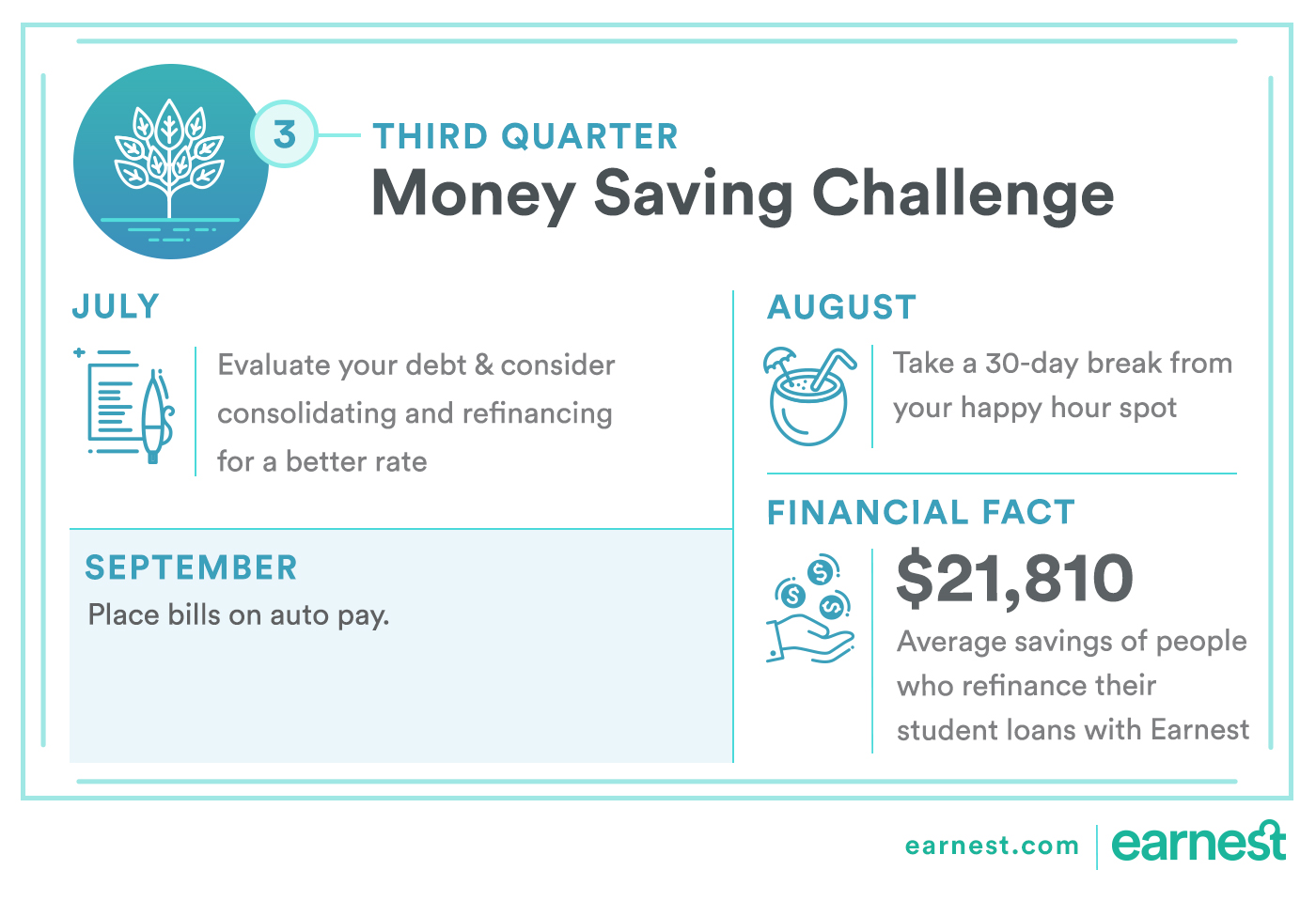

Take a look at this infographic below from Earnest, they offer personal loans as well as student loan financing. See some of the tips that we came up with to help you save money this year.

We dug into some pretty important money habits above, join me in my 2017 Money Saving Challenge. As you know this blog is about creating a better life for yourself so you can create a life you love. Having your finances in order is a big part of this. Applying these tips above is a great way to get you on track!

J.

TEAMI BLENDS

TEAMI BLENDS HYDRA-ESSENTIEL

HYDRA-ESSENTIEL 27 THINGS

27 THINGS